What is Blockchain? How does it work?

Crypto BasicsBlockchain is a decentralized, secure, and transparent digital ledger that records transactions in linked, tamper-resistant blocks across a distributed network. Originally developed for Bitcoin, it now powers applications like cryptocurrencies, smart contracts, supply chain management, and more. Blockchain uses consensus mechanisms like Proof of Work (PoW) or Proof of Stake (PoS) to validate transactions, eliminating the need for central authorities. Its key strengths lie in transparency, immutability, and resistance to fraud, making it a transformative technology across industries. For altcoin investments, evaluate the project team, technology, use case, and token utility to ensure informed decisions.

At its core, blockchain is a distributed ledger technology that securely records transactions across a network of computers. Each block in the blockchain contains a list of transactions, a timestamp, and a reference to the previous block, creating a continuous chain. This architecture ensures transparency and makes the blockchain resistant to tampering, as every computer (node) in the network maintains an identical record of the chain.

Key Features of Blockchain Technology

-

Decentralization

Blockchain eliminates the need for a central authority, as nodes across the network collectively validate transactions through consensus mechanisms. This distributed structure ensures that the data remains secure and integral. -

Security and Transparency

By leveraging cryptographic techniques, blockchain safeguards data from tampering. Its use of consensus mechanisms and cryptographic hashes ensures data integrity, fostering trust in its applications. -

Adaptable Versatility

Although blockchain was initially developed for Bitcoin, its versatility now supports various applications, such as supply chain management, voting systems, identity verification, and more. Since Bitcoin's introduction in 2009, the blockchain ecosystem has expanded into a global industry worth billions.

How Blockchain Functions: A Breakdown

In a blockchain, transaction data is grouped into blocks, functioning similarly to cells in a spreadsheet. Once a block is full, an encryption algorithm processes the data, producing a unique hexadecimal identifier known as a hash.

-

Hashing Mechanism: Each block’s hash is stored in the subsequent block's header, linking them securely. This chained structure ensures tamper resistance.

-

Genesis Block: The foundational block in the blockchain network is referred to as “The Genesis Block.” Every subsequent block is built upon it.

Structure of a Block

Each block typically contains:

-

Hash: A unique cryptographic fingerprint representing the block's data. Any alteration in the data drastically changes the hash, easily exposing tampering.

-

Previous Block Hash: Links each block to its predecessor, forming the chain structure.

-

Timestamp: Records the exact time when the block is created.

Transaction Verification Process

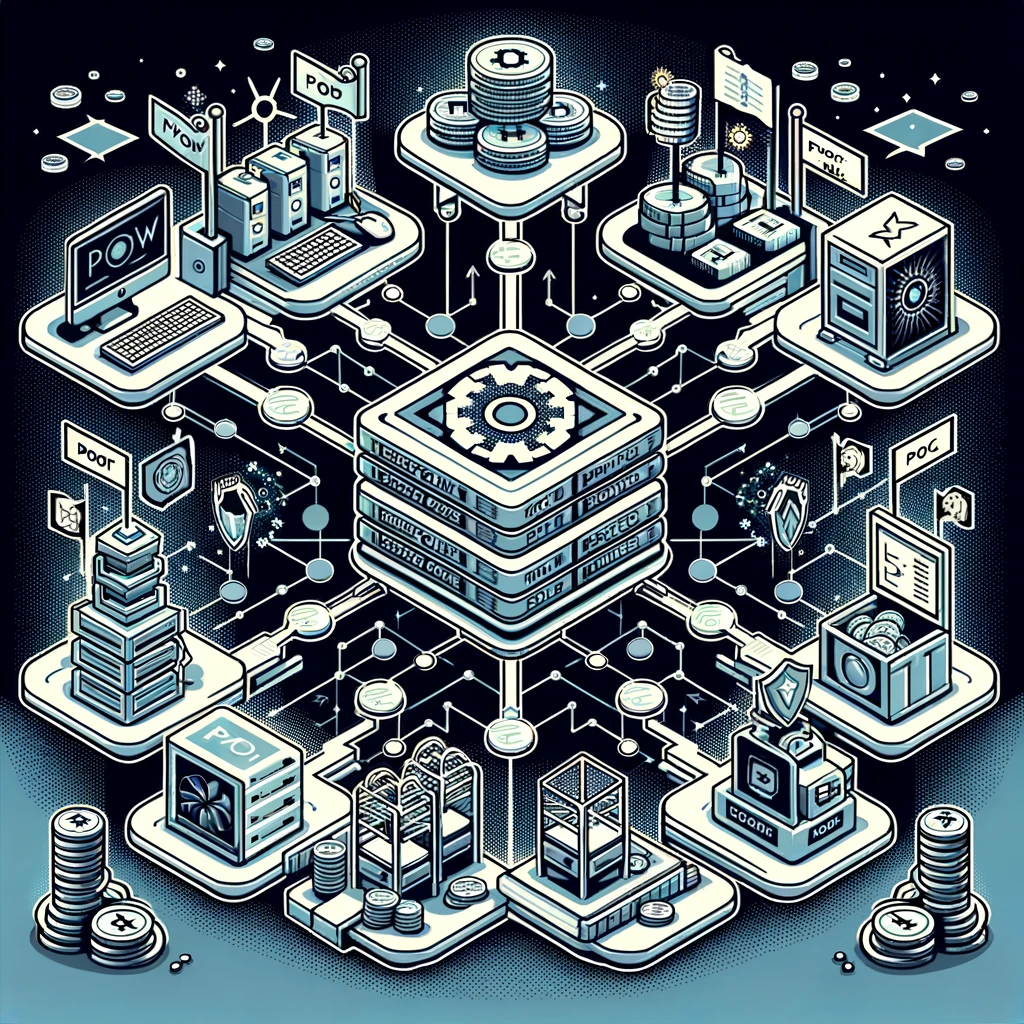

Not all participants can add blocks. Special nodes, called miners, compete to solve complex cryptographic puzzles using consensus mechanisms. The winner gets to verify the transactions and add a new block. Common consensus mechanisms include:

-

Proof of Work (PoW):

-

Used in Bitcoin.

-

Miners solve complex puzzles to validate transactions, earning cryptocurrency rewards.

-

Criticized for high energy consumption.

-

-

Proof of Stake (PoS):

-

Validators stake their cryptocurrency holdings to validate transactions.

-

Offers an energy-efficient alternative to PoW.

-

-

Delegated Proof of Stake (DPoS):

-

Participants vote for delegates to validate transactions.

-

Faster than PoS but introduces some centralization.

-

-

Proof of Authority (PoA):

-

Pre-selected validators, usually organizations, oversee transactions.

-

Offers efficiency but compromises on decentralization.

-

-

Proof of Capacity (PoC):

-

Validators use storage space to verify transactions.

-

An energy-saving alternative to PoW.

-

-

Proof of Importance (PoI):

-

Selects validators based on their network reputation and contributions.

-

Decentralization and Security: Core Strengths of Blockchain

Blockchain's decentralized nature is its cornerstone advantage. Instead of relying on a single server, the blockchain is replicated and distributed across numerous nodes, making it highly secure and resistant to attacks.

Key Elements of Blockchain Security

-

Cryptography: Ensures data integrity through cryptographic hashes and digital signatures. Any unauthorized modification is flagged by the network.

-

Immutability: Once added to the chain, data becomes irreversible, building trust and transparency across the system.

Types of Blockchain Networks

Different blockchain types cater to diverse needs:

-

Public Blockchains:

-

Private Blockchains:

-

Permissioned networks, restricted to specific participants, often used for business applications like internal record-keeping or supply chain tracking.

-

Popular Applications of Blockchain Technology

-

Cryptocurrencies: Blockchain underpins digital currencies like Bitcoin, enabling secure peer-to-peer transactions.

-

Smart Contracts: Self-executing agreements stored on the blockchain, removing intermediaries and increasing efficiency.

-

Supply Chain Management: Tracks goods movement across the supply chain, ensuring transparency and reducing fraud.

How to Choose an Altcoin for Investment

Investing in altcoins is a complex and risky process. To make an informed decision, consider the following factors:

1. Research the Project Team and Community

-

Check if the developers’ information is public and whether the community is actively participating in discussions.

-

An abandoned project with anonymous developers may signal a lack of trustworthiness.

-

Evaluate backers and partners to ensure long-term sustainability.

2. Analyze the Technology

-

Does the project solve a real-world problem?

-

Assess the network’s speed, security, and operating costs.

-

Look for auditing reports from reputable organizations and user-friendly technology.

3. Token Utility and Economics

-

Determine the utility of the network’s token.

-

Evaluate the tokenomics, circulation supply, and maximum supply ratio.

-

Investigate the revenue model to ensure its sustainability.

By carefully exploring these factors, you can identify altcoins that offer value and align with your investment goals.

Conclusion

Blockchain has redefined how we approach transparency, security, and efficiency across multiple domains. From its origins as the backbone of Bitcoin to its broader applications in various sectors, blockchain continues to revolutionize the digital landscape. Understanding its fundamentals and potential can empower individuals and businesses to leverage this transformative technology effectively.

Disclaimer: None of the information in this article is trading advice. Always use proper risk management and DYOR.