The cryptocurrency ecosystem has significantly evolved since its early days. By Q4 2025, stablecoins have become essential tools in the broader blockchain economy, facilitating payments, trading, decentralized finance (DeFi), and cross-border transactions. Their value lies in offering digital utility without the volatility associated with traditional cryptocurrencies.

What Are Stablecoins?

Stablecoins are digital assets designed to maintain a consistent value typically pegged to stable real-world references, including:

-

Fiat currencies (e.g., USD, EUR)

-

Commodities (e.g., gold)

-

A basket of assets

Unlike highly volatile cryptocurrencies such as Bitcoin or Ethereum, stablecoins provide:

-

Price predictability and stability

-

Faster transaction settlements

-

Practical utility in DeFi protocols and trading platforms

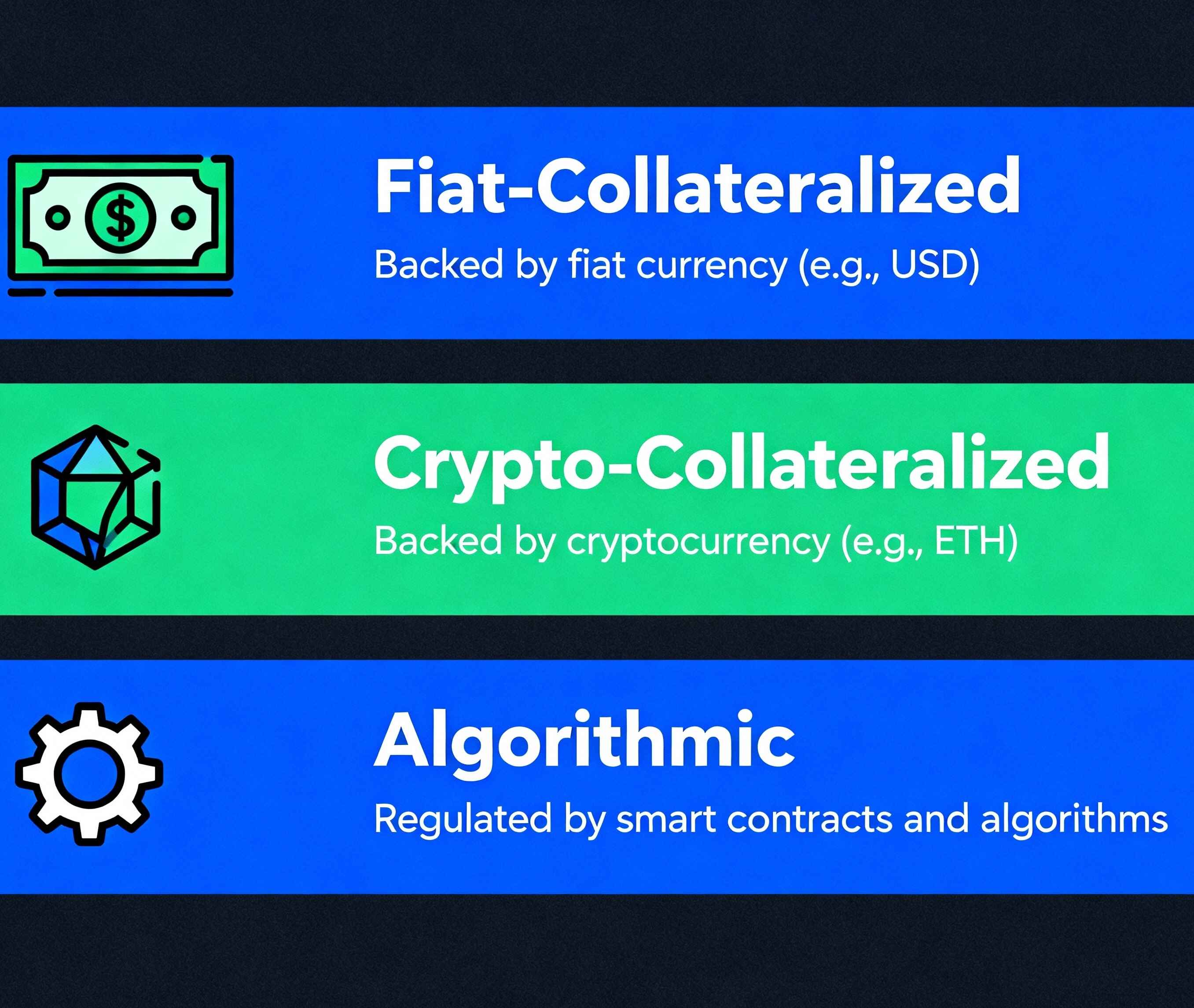

Types of Stablecoins Explained

-

Fiat-Collateralized Stablecoins

These stablecoins are pegged to fiat currencies and fully backed by fiat reserves managed by centralized entities. Their reserves are regularly audited to ensure transparency.

Examples: USDT, USDC, TUSD, PYUSD -

Crypto-Collateralized Stablecoins

Backed by other cryptocurrencies, these are often overcollateralized to absorb volatility. Their value stability is maintained via smart contracts.

Example: DAI (Governed by MakerDAO) -

Algorithmic Stablecoins

These are not backed by collateral assets but maintain their peg by algorithmic adjustments to supply. This type carries a higher risk profile due to its dependency on algorithms alone.

Examples: FRAX and other algorithmic projects (many have failed, like UST)

Top Stablecoins by Market Capitalization in October 2025

Note: The list has been updated to correct previous errors, remove non-stablecoin assets, and include issuer and network details.

-

-

Market Cap: Approx. $155 billion

-

Issuer: Tether

-

Networks: Ethereum, Tron, Solana, Binance Smart Chain, and others

-

Minting: Primarily institutional; accessible on centralized exchanges

-

Notes: Most liquid and widely used stablecoin

-

-

-

Market Cap: Approx. $61 billion

-

Issuer: Circle

-

Networks: Ethereum, Solana, Avalanche, Base, and more

-

Minting: Institutional and vetted retail partners

-

Notes: Fully regulated and audited with transparent reserves

-

-

-

Market Cap: Approx. $7 billion

-

Issuer: Sky

-

Networks: Ethereum and proprietary chains

-

Minting: Institutional partners primarily

-

Notes: Note that this stablecoin’s stability claims have been questioned, distinguishing it from traditional stablecoins

-

-

-

Market Cap: Approx. $5.9 billion

-

Issuer: Ethena Labs

-

Notes: Synthetic stablecoin with delta-neutral hedging, focuses on yield and stability through derivatives

-

-

-

Market Cap: Approx. $3.6 billion

-

Issuer: MakerDAO

-

Networks: Ethereum, Polygon, others

-

Minting: Open to users via collateralized vaults

-

Notes: Crypto-collateralized, governed by decentralized community

-

-

-

Market Cap: Approx. $2.2 billion

-

Issuer: World Liberty Financial

-

Networks: Ethereum, Binance Smart Chain

-

Minting: Institutional and retail options available

-

Notes: Fully collateralized and compliant stablecoin

-

-

-

Market Cap: Approx. $1.5 billion

-

Issuer: First Digital Labs

-

Networks: Mainly Ethereum and Polygon

-

Minting: Institutional focus, growing adoption in Asia

-

-

-

Market Cap: Approx. $1.46 billion

-

Issuer: Tether Limited

-

Notes: Euro-pegged variant targeting geographic diversification

-

-

-

Market Cap: Approx. $961 million

-

Issuer: Paxos Trust Company

-

Supported By: PayPal

-

Networks: Ethereum

-

Minting: Retail users supported via PayPal’s platform

-

Notes: Focused on retail payments, fast remittances, and bridging Web2 and crypto

-

Key Advantages of Stablecoins

-

Instant settlement in cross-border payments

-

Vital utility in DeFi as collateral, lending, and liquidity solutions

-

Hedging instruments in volatile cryptocurrency markets

-

Enhanced remittance processes with reduced fees and faster transfers

Regulatory and Market Outlook in 2025

The landscape for stablecoins is becoming more regulated and transparent. Significant legislative advancements have occurred:

-

U.S. Stablecoin GENIUS Act (2025):

Enacted in July 2025, this federal law establishes clear regulatory frameworks requiring stablecoin issuers to maintain 100% reserve backing with liquid assets like U.S. dollars or Treasuries. It mandates anti-money laundering compliance, consumer protections, and prioritizes holders' claims in insolvency scenarios. -

Global Coordination by the G20 Financial Stability Board (FSB):

In October 2025, the FSB emphasized the systemic risks posed by stablecoins and called for comprehensive international regulatory approaches to mitigate financial stability risks. The board advocates for consistent global standards to oversee crypto-assets.

These developments mark a critical step towards balancing innovation with trust and stability in digital finance.