Low-Risk High-Yield Stablecoin Strategies: Top DeFi Platforms for Beginners to Make Passive Crypto Income

Investing in cryptocurrencies doesn't always have to involve massive risks or volatile market swings. With decentralized finance (DeFi) and stablecoins, you can safely earn low-risk, high-yield passive income. By selecting the right DeFi platforms, it's possible to grow your investments while avoiding the pitfalls of traditional crypto volatility. Here's how to earn passive income with stablecoins and navigate the world of yield farming with ease.

Why Stablecoins Are Perfect for Passive Income

Stablecoins, like USDC, USDT, and DAI, are pegged to fiat currencies (e.g., USD), making them a reliable choice for earning returns in crypto savings accounts. Unlike assets such as Bitcoin or Ethereum, stablecoins maintain a steady value, ensuring steady profits without exposure to the dramatic ups and downs that come with other cryptocurrencies.

Key Benefits

-

Stable Value: Protects against volatility and is pegged to fiat currencies like USD.

-

Easy to Use: Often found on major DeFi platforms for lending, staking, or liquidity pools.

-

Reduced Risk: No impermanent loss compared to trading volatile cryptocurrencies in pairs.

-

Liquid Assets: Stablecoins are widely accepted across DeFi platforms, bolstering opportunities to earn.

Whether you're new to the world of crypto or an experienced investor, earning interest with stablecoins is a simple and effective way to explore DeFi.

What Is DeFi Yield Farming?

DeFi yield farming allows users to lend or stake their stablecoins in liquidity pools, earning interest or rewards. Essentially, your assets are utilized by DeFi platforms to provide loans or liquidity to the system, and in exchange, you earn returns based on your share.

How It Works:

-

Supply Stablecoins: Deposit assets like USDC or DAI into a DeFi protocol.

-

Earn Yields: The platform uses your funds for lending or liquidity purposes, offering rewards such as interest, platform-native tokens, or governance tokens (e.g., COMP or CRV).

-

Reinvestment: Allows for compounding returns.

Risks to Know

While passive income with crypto can be rewarding, it's vital to understand potential risks:

-

Smart Contract Risks: Vulnerabilities in underlying code.

-

Liquidity Issues: Limited access during high demand.

-

Platform Trustworthiness: Choose audited, insured, or transparent protocols to minimize exposure.

Successful yield farming requires choosing the best low-risk DeFi platforms that prioritize your security and ease of use.

Top 5 DeFi Platforms for Yield on Stablecoins

Not all DeFi platforms are created equal. We've handpicked five top DeFi platforms for earning passive income using stablecoins, considering yields, features, and security.

1. Aave

-

APY: ~2%–6% for stablecoins (e.g., USDC, DAI, and USDT).

-

What’s Unique: Seamless lending and borrowing mechanisms, user-friendly interface.

-

Security Measures: Regular code audits and integration with insurance providers like Nexus Mutual.

-

Why Choose Aave: Perfect for those seeking reliable yields with established security protocols.

More than just a lending platform, Aave is a cornerstone for low-risk passive income in DeFi, offering flexible options for earning returns.

2. Curve Finance

-

APY: 2%–10%, depending on stablecoin pools (e.g., USDT/USDC).

-

What’s Unique: Focuses entirely on stablecoin liquidity pools, reducing risks like impermanent loss.

-

Security Measures: Continuously audits smart contracts and offers incentives via CRV tokens.

-

Why Choose Curve: Ideal for those looking to optimize stablecoin yield farming with minimized risks.

Curve’s strategic focus on stablecoin trades ensures steady and predictable yields for passive earners.

3. Compound

-

APY: Competitive rates of ~4%–5% on USDC and DAI deposits.

-

What’s Unique: Rewards with COMP tokens, which can be staked for even greater earnings.

-

Security Measures: Extensive audits and on-chain transparency.

-

Why Choose Compound: A well-established lending platform with a focus on liquidity and innovation.

One of the most popular options for earning passive income with crypto, Compound remains a leader in the DeFi ecosystem.

4. Yearn Finance

-

APY: Dynamic vault yields, typically 3%–8% for stablecoin deposits.

-

What’s Unique: Automates yield farming strategies via “vaults” that optimize returns.

-

Security Measures: Regularly audited contracts ensure operational safety.

-

Why Choose Yearn Finance: A great option for users preferring automation in DeFi yield platforms.

Yearn simplifies earn interest with stablecoins, making it especially friendly for crypto novices.

5. Lido Finance

Initially focused on ETH staking, Lido is expanding its stablecoin offerings. With plans to include stablecoin-based gains, its entry into stablecoin yield farming is highly anticipated in 2025.

-

APY: Dynamic and variable yields (rates for stablecoins expected to align with competitive DeFi standards).

-

What’s Unique: Focuses on scaling through Layer-2 networks like Optimism and Arbitrum, reducing gas fees significantly. Lido is expanding its platform from liquid staking to stablecoin yield farming, partnering with leading liquidity pools for enhanced earning opportunities.

-

Security Measures: Regular smart contract audits by firms like Sigma Prime and Quantstamp. Transparent, community-driven governance via its LDO token holders. Collaborations with insurance providers like Nexus Mutual, offering users peace of mind.

-

Why Choose Lido: Its established reputation in liquid staking and entry into Layer-2 solutions make it a strong emerging platform for stablecoin yield farming. By lowering transaction costs and focusing on innovation, Lido aims to become a trusted choice for investors seeking low-risk, high-yield opportunities.

Lido Finance’s move into stablecoin farming is an exciting development in the DeFi yield platform ecosystem, offering both accessibility and reliability for new and advanced users.

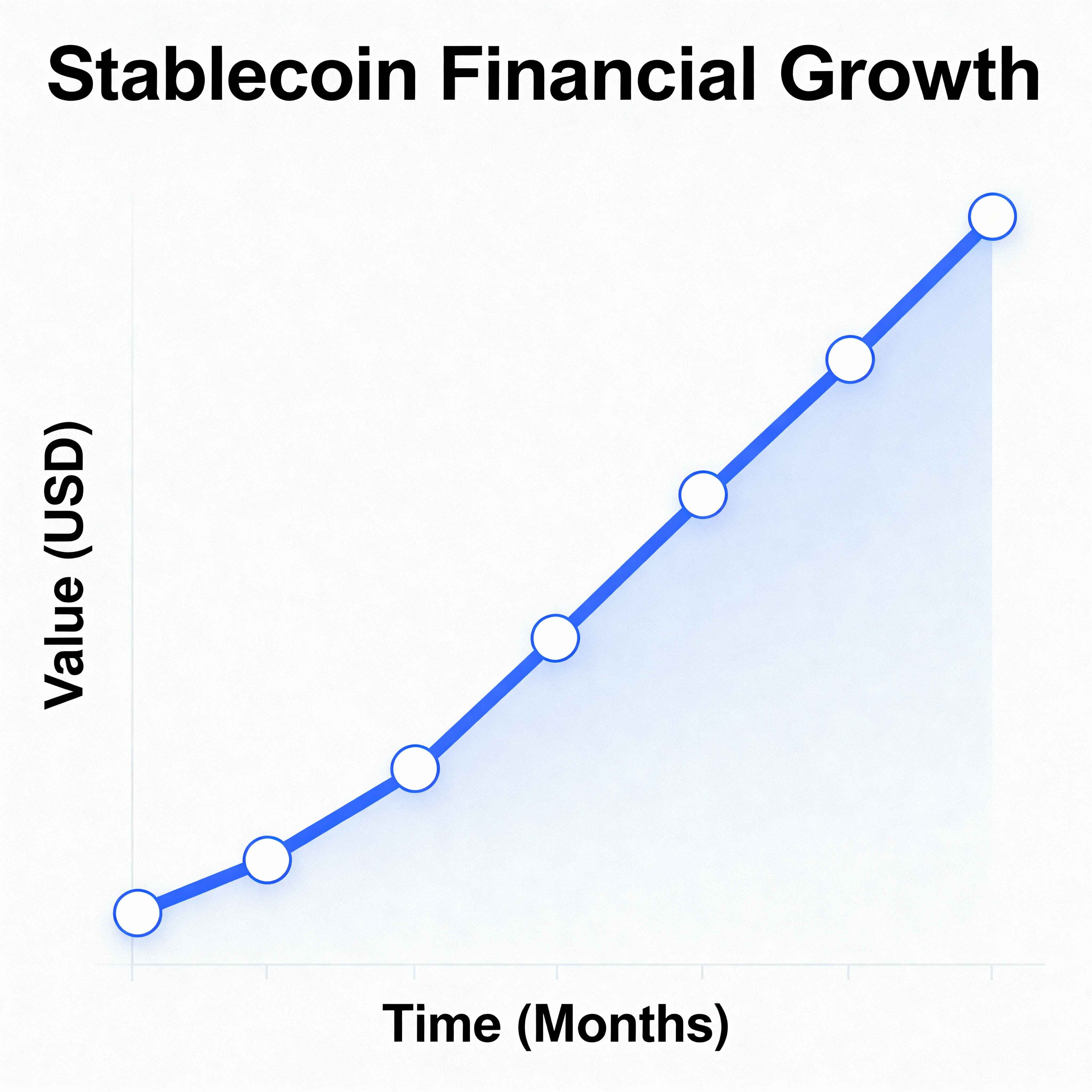

How Much Can You Earn? Comparing Stablecoin Yields

To give you a general idea, here's a quick comparison of typical APY on stablecoins across top DeFi platforms:

| DeFi Platform | APY (Approx.) | Best Stablecoins Supported | Security Features |

| Aave | ~2%–6% | USDC, DAI, USDT | Regular Audits, Insurance |

| Curve Finance | ~2%–10% | USDC, DAI | Comprehensive Audits |

| Compound | ~4%–5% | USDC, DAI | Transparent Governance |

| Yearn Finance | ~3%–8% | DAI, USDC | Automated Yield Mechanism |

The potential to earn low-risk, high-yield passive income with stablecoins makes these platforms top picks among both crypto enthusiasts and beginners.

Step-by-Step: How to Start Earning Passive Income with Stablecoins

-

Buy Stablecoins: Exchange fiat for USDC, USDT, or DAI on platforms like Coinbase.

-

Set Up a Wallet: Secure your stablecoins in a wallet such as MetaMask or Ledger.

-

Select a DeFi Platform: Use trusted options like Aave, Compound, or Curve Finance to begin.

-

Deposit and Earn: Follow the platform’s guide to stake or lend your stablecoins.

-

Withdraw & Repeat: Periodically claim your rewards or reinvest for compounding gains.

Tip: Start with smaller amounts to explore the platform and its features safely.

FAQs on DeFi Passive Income with Stablecoins

1. Are stablecoin yields safe in DeFi?

Yes, if you choose reliable, well-audited protocols like Curve or Aave. Diversify your holdings and choose platforms carefully.

2. What’s the best stablecoin for earning passive income?

USDC and DAI are widely considered reliable and well-supported across DeFi platforms.

3. Can I lose money with stablecoin yield farming?

Risks exist, such as smart contract failures or platform insolvency. Stick to highly reputable platforms to mitigate these risks.

Conclusion

When done right, earning passive income with stablecoins offers one of the safest and most rewarding opportunities within the crypto space. With platforms like Aave, Curve Finance, and Yearn Finance, you can securely generate low-risk, high-yield income while navigating the exciting DeFi landscape.

Remember, while the rewards are promising, it’s crucial to manage risks, conduct in-depth research, and start small. As the world of DeFi evolves, stablecoins will likely remain a cornerstone of reliable investments for both beginners and advanced users.

Disclaimer: The contents of this article aim solely to inform the reader of a possible investment strategy, but in no way constitute investment advice. Always do your due diligence and excersise proper risk-management.